Workplace Giving

What is workplace giving?

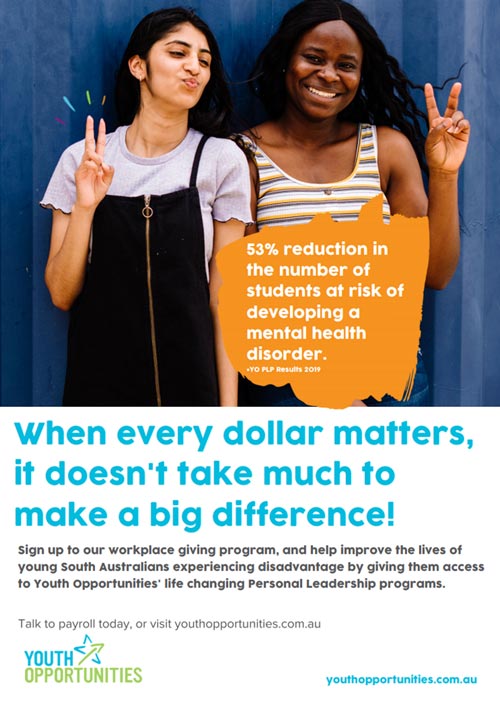

When every dollar matters, it doesn’t take much for you to make a big difference to young people experiencing disadvantage, and workplace giving is one of the most simple and effective ways to achieve your goals.

Through a workplace giving program, you, or your organisation, nominate Youth Opportunities as preferred charity and specify the amount you wish to be donated each pay period. These funds are then deposited directly to Youth Opportunities and, as they are deducted pre-tax, the tax benefit is immediate.

A fantastic way for businesses to support their employees preferred charitable causes, or to encourage workplace giving as a CSR initiative, is to offer a matched contribution program where you match the annual contribution of your staff – essentially doubling their impact to a cause that is meaningful to them.

Benefits for Employees

- Workplace giving is easy to set up, just download our WPG form and provide to your payroll office.

- As donations are pre-tax, it allows you to give more, for less – a $10 donation from your pre–tax pay equates to $6.75* out–of–pocket. And, if you ask your employer to match your donation, you’ll be helping contribute $20 to Youth Opportunities.

- Giving is not only good for you but it feels great! Giving to a cause that you believe in is of massive benefit to you and to the recipient of your donation!

Benefits for Employers

- 86 per cent of employees say workplace giving makes them proud to work for their company.

- 80 per cent say a workplace giving program demonstrates ‘a genuine commitment to the community and makes their company a better place to work’.

- 94 per cent want giving to be easy and say workplace giving makes giving easy.

Want to learn more?

Contact Kerin Hayden at kerin.hayden@youthopps.com.au if you would like more information.